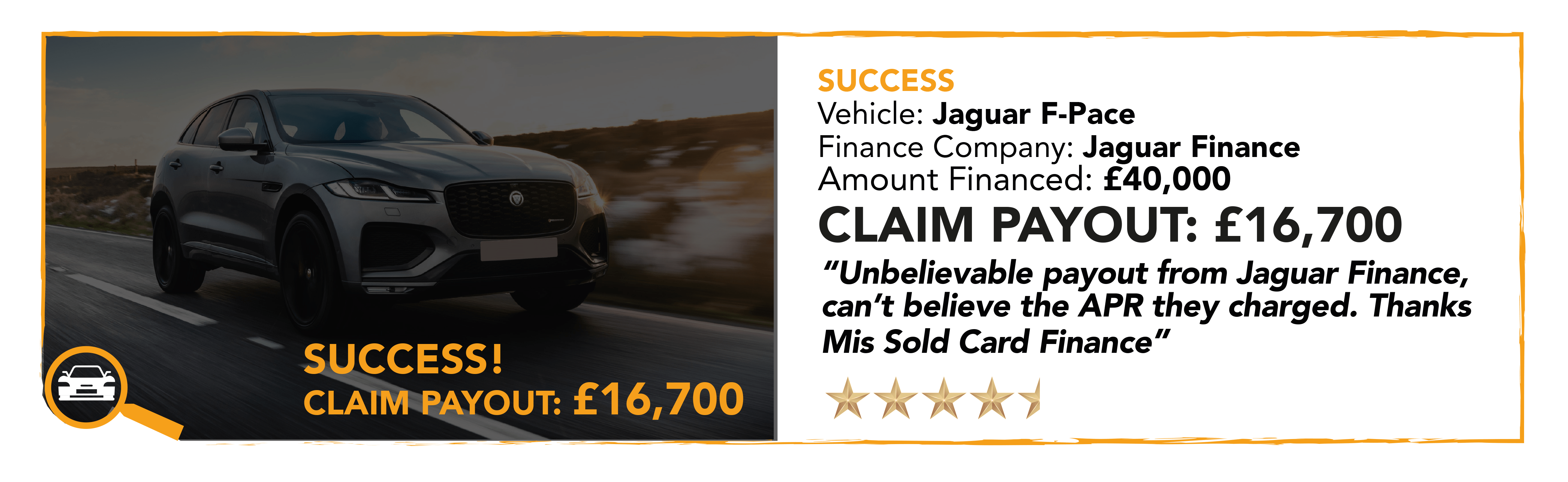

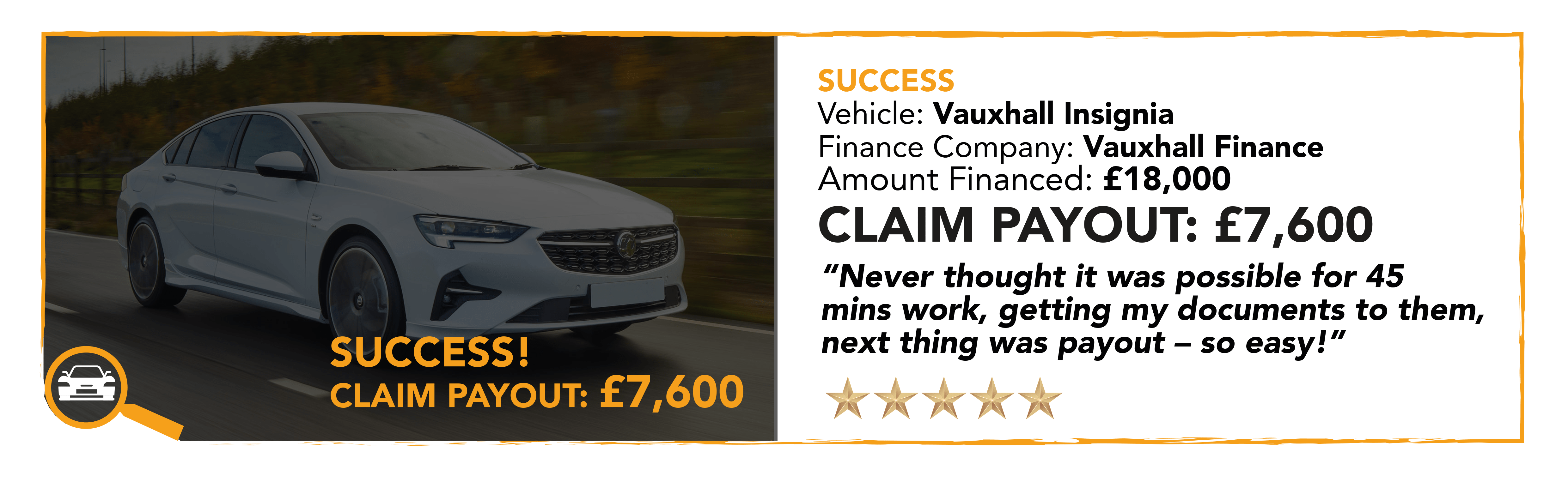

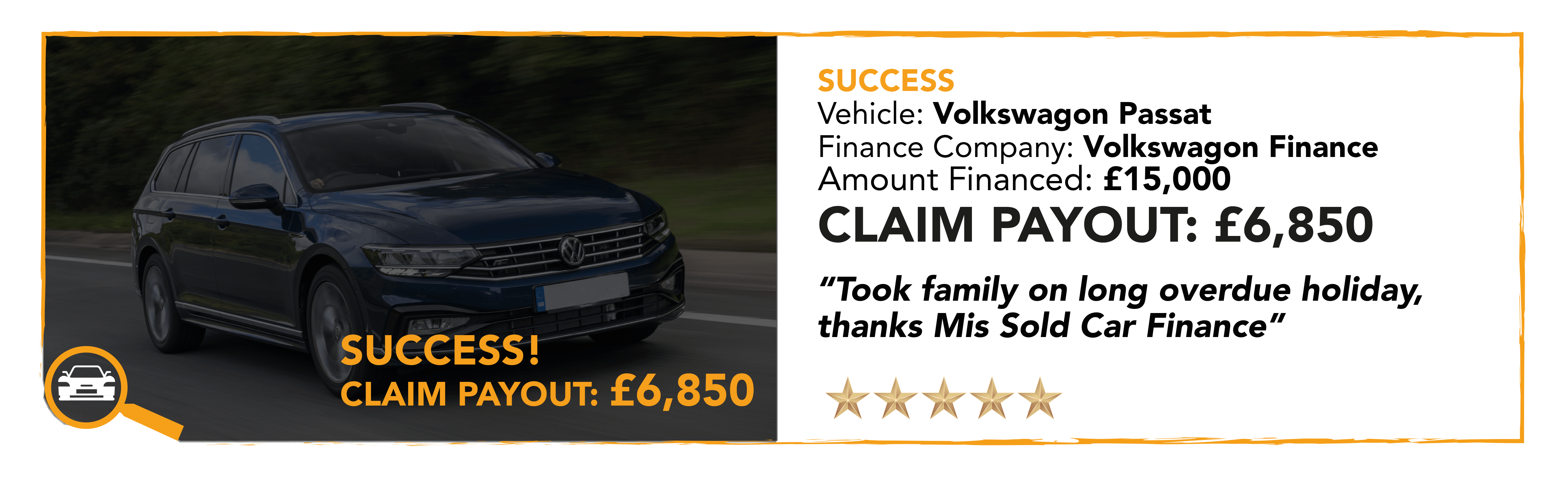

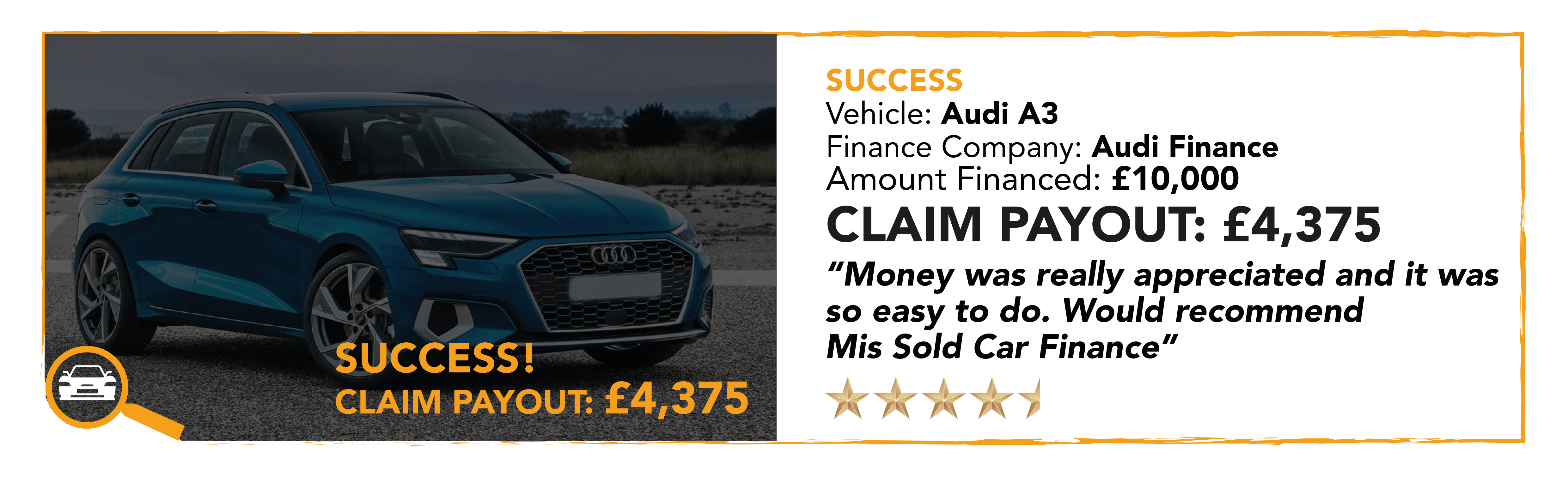

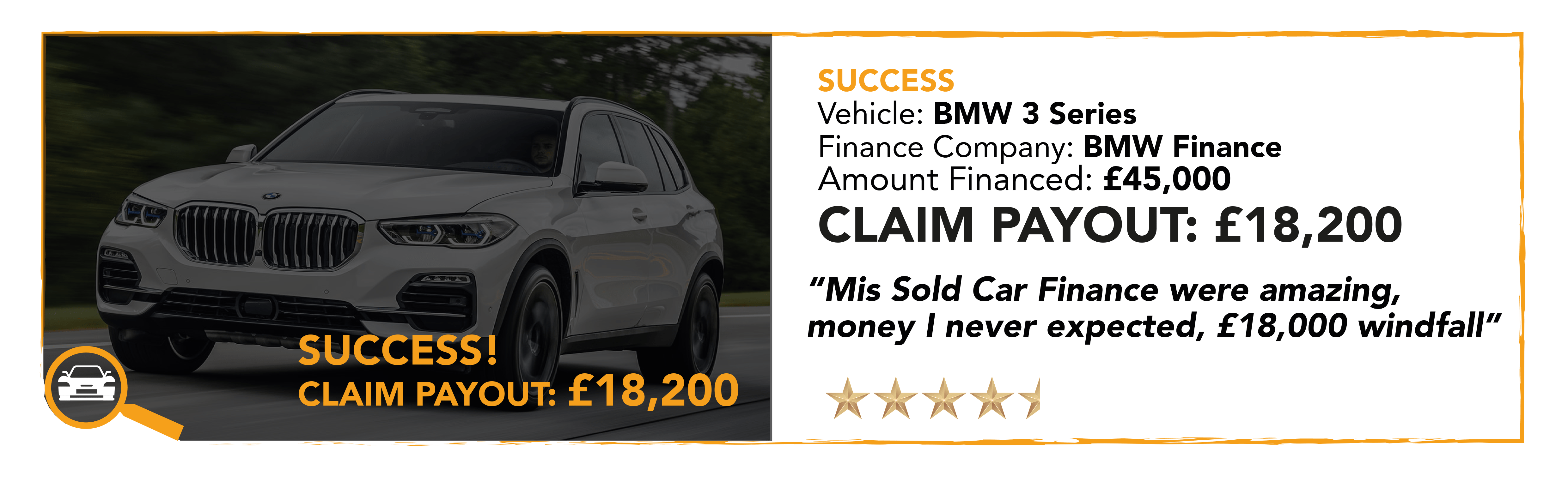

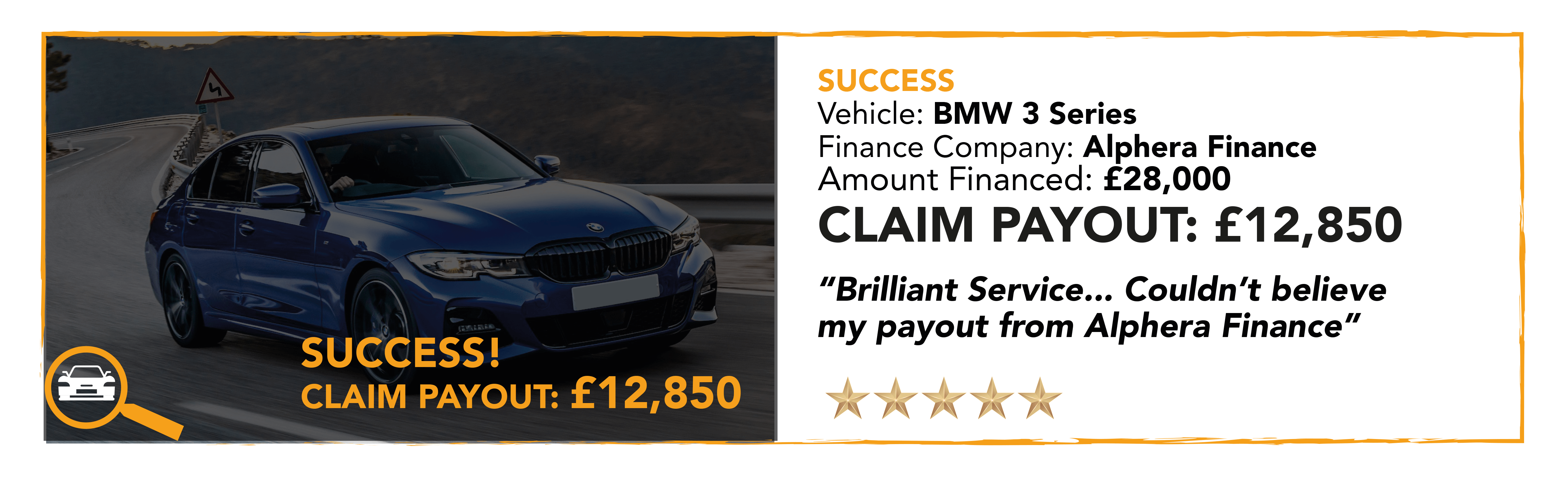

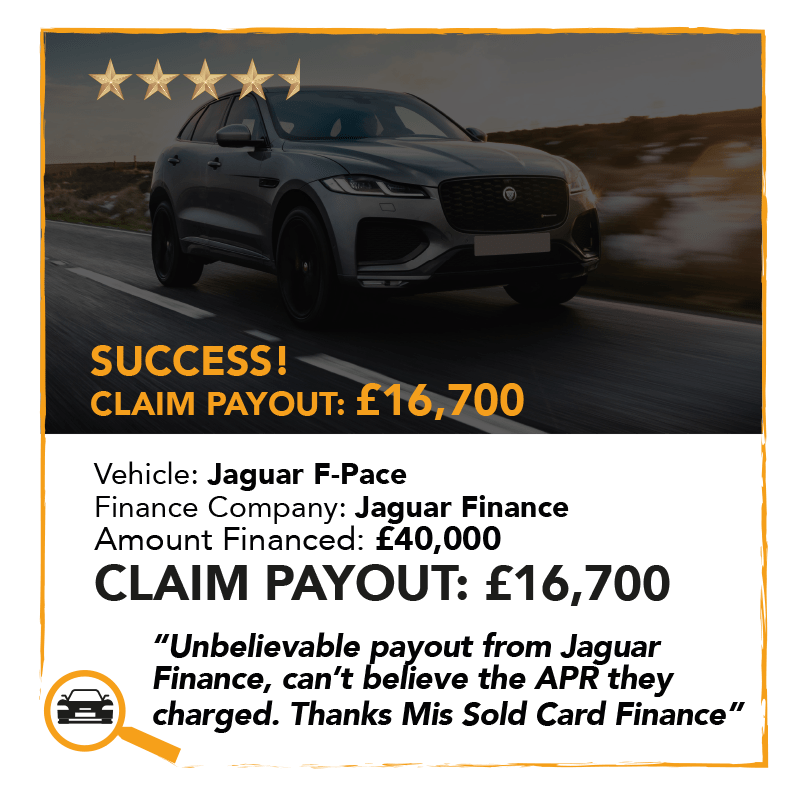

This depends on the amount that you financed and the APR, generally the higher the amount financed the larger the amount of claim. Whether you had a PCP or Hire Purchase our average pay-out on vehicles £25,000 and over is £13,500. Our average pay-out on vehicles under £25,000 is £8,300. Want to know how much your claim could be worth, Hit the button below and get a valuation in less than 10 seconds.

What do I need to do to get my money back?

It’s simple… Take ten seconds to fill out our instant valuation form to figure out your claim value, then hit the ‘Start your claim’ button to get started. Once you’ve started your claim you will be asked to provide the following information to proceed with the claim:

Name

Email Address

Phone Number

Finance Agreement (Copy)

Proof Of ID (passport or driving licence)

Proof Of Address (within the last 2 months)